child tax credit for december 2021 amount

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Your newborn should be eligible for the Child Tax credit of 3600.

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only.

. The full credit is available for heads of households earning up to 112500 a year. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return. The American Rescue Plan Act expands the child tax credit for tax year 2021.

The child tax credit was expanded significantly in 2021 and many families received payments in advance but you need to file an income tax return in order to get the full benefit. Lets say you qualified for the full 3600 child tax credit in 2021. The IRS generally based eligibility for the credit and advance payments and calculated the amount of the payment based on your 2020 return.

In 2021 only the federal child tax credit was temporarily boosted to a maximum of 3600 per child under President Bidens plan. The credit is not a loan. Advance Child Tax Credit payment amounts are not based on the Credit for Other Dependents which is not refundable.

The 2021 Child Tax Credit will be available to nearly all working families with an income of under 150000 for couples or 112500 for a single-parent household. Last year the Internal Revenue Service paid out six months of advance. To reconcile advance payments on your 2021 return.

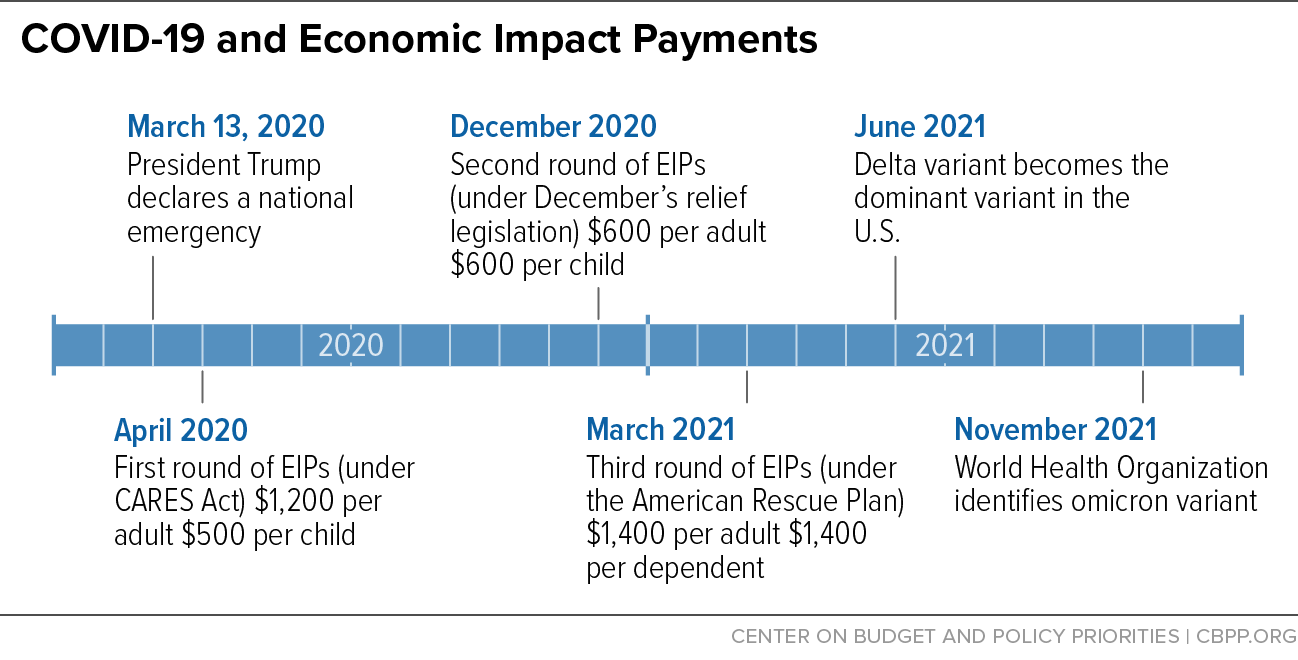

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit. The amount of policy support we got in 2020 and 2021 was a massive amount said Jared Franz an economist at the Capital Group.

The Child Tax Credit provides money to support American families. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one.

In 2021 the IRS sent out six monthly payments from mid-ilies who didnt opt out of the payments. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

The remaining 1800 will be. Families can receive half of their new credit between July and December 2021 and the. 250 per month for each qualifying child age 6 to 17.

For more information about the. 112500 if you are filing as a head of household. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

Stimulus checks and the like helped minimize the Delta wave but. In previous years 17-year-olds werent covered by the CTC. And 3000 for children ages 6 through 17 at the end of 2021.

The full amount of the child tax credit for 2021 is refundable. Simple or complex always free. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Discover trends and view interactive analysis of child care and early education in the US. The Child Tax Credit is a fully refundable tax credit for families with qualifying children. 2021 Child Tax Credit.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Do not call the IRS. These Child Tax Credit frequently asked questions focus on information needed for the tax year 2021 tax return.

On June 29 the New Jersey legislature voted to approve a 500 tax credit for families with children that earn 30000 or less a year. If the IRS processed your 2020 tax return or 2019 tax return before the end of June these monthly payments began in July and continued. Eligibility for Advance Child Tax Credit.

The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6. If youre eligible you could receive part of the credit in 2021 through advance payments of up to. However the credit returned to its pre-pandemic level of 2000 this year.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. File a federal return to claim your child tax credit. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

In TurboTax Online to claim the Recovery Rebate credit please do the following. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Any remaining Child Tax Credit benefits will be paid when eligible parents and guardians.

Complete IRS Tax Forms Online or Print Government Tax Documents. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old.

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. 3600 for children ages 5 and under at the end of 2021. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax credit.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B. Our phone assistors dont have information beyond whats available on IRSgov. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17.

Families with 17-year-old children will be eligible to claim the Child Tax Credit for the first time under the new rule. December 2021 based on the information contained in that return. Get the up-to-date data and facts from USAFacts a nonpartisan source.

Your newborn child is eligible for the the third stimulus of 1400. The advance payments generally accounted for half of a familys 2021 child tax credit. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

The credit increased from 2000 per. Here is some important information to understand about this years Child Tax Credit. Families with a single parent.

Enter your information on Schedule 8812 Form. Married couples filing a joint return with income of 150000 or less. Get your advance payments total and number of qualifying children in your online account.

It also made the. SeeChild Tax Credit Guidance Updated by IRSFindStimulus Update -- How To Request an IRS Trace for Lost Child Tax Credit Payment The American Rescue Plan Act of. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

Adance Tax Payment Tax Payment Dating Chart

Missing A Child Tax Credit Payment Here S How To Track It Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Don T Delay Get Your Health Covered Today Health Plan Affordable Health Health

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Parents Guide To The Child Tax Credit Nextadvisor With Time

4 Commonly Overlooked Tax Deductions Not To Miss Tax Deductions Tax Refund Tax Time

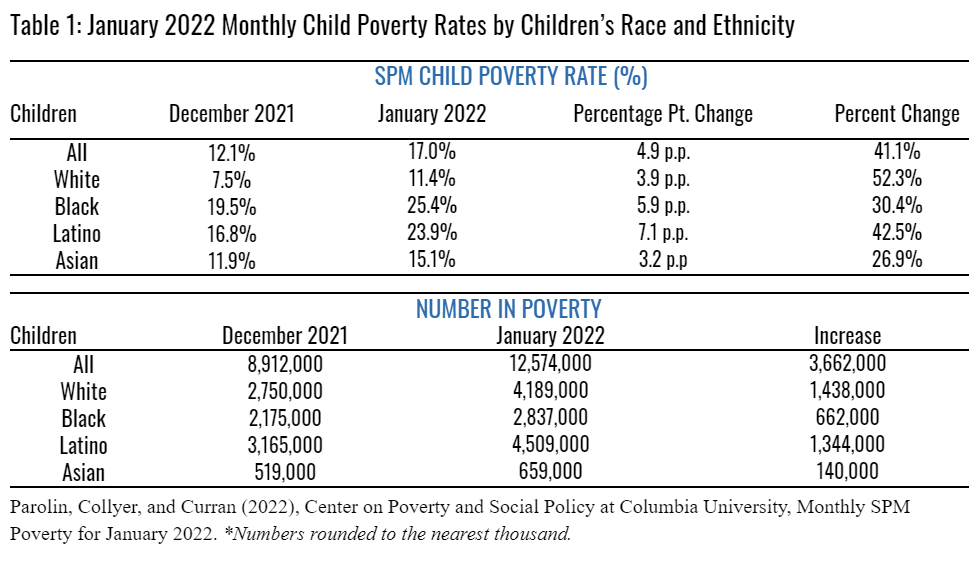

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Find The List Of All The Important Due Dates For Gst Compliance For The Month Of April 2021 Make Sure That You File Y Indirect Tax Billing Software Due Date

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet