marin county property tax due dates 2021

We would like to show you a description here but the site wont allow us. The earliest archaeological evidence of human settlements in the Bay Area dates back to 800010000 BCE.

55 Durham Rd San Anselmo Ca 94960 Realtor Com Building A House Home And Family Durham

4025 Partial Use Tax Exemption.

. 4005 California Department of Tax and Fee Administration Review Request. 4035 Transactions Not Subject to Use Tax. 4010 Calculating Use Tax Amount.

4050 Use Tax. Prior to the moratorium executions were frozen by a federal court order since 2006 and the litigation resulting in the court order has been on hold since the. Light Rye 75 extraction 0.

1 real property 799 Spousal Property Petition 1 real property 749 Heggstad Petition 1 Petitioner 1 real property. 4015 Credit for Tax Paid to Another State. A change or correction to the.

Simplified Probate Proceeding to Transfer Real Property Not Exceeding 55425 up to 2 Petitioners. 14 cup 30g. 4045 Use Tax Basis.

Prices valid from Thursday January 28 2021 to Wednesday February 3. 4030 Refund of Use Tax. San Francisco Marin County and the Lamorinda area all have substantial Jewish communities.

Capital punishment in California is a legal penalty but at present it is not allowed to be carried out because as of March 2019 executions are halted by an official moratorium ordered by Governor Gavin Newsom. Vital records property assessment and records tax collection public health agricultural regulations and building inspections among. 1 real property 649 Simplified Probate Proceeding to Transfer Real Property Not Exceeding 166425 up to 2 Petitioners.

Caudwells Mill is a unique Grade II listed historic water turbine powered roller flour mill. 2021-22 Secured Property Taxes Payment Activity Notice. 4040 Transactions Subject to Use Tax.

That the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. The sourdough is mixed with 30. A bill that replaces the Annual Secured Property Tax Bill due to the following reasons.

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

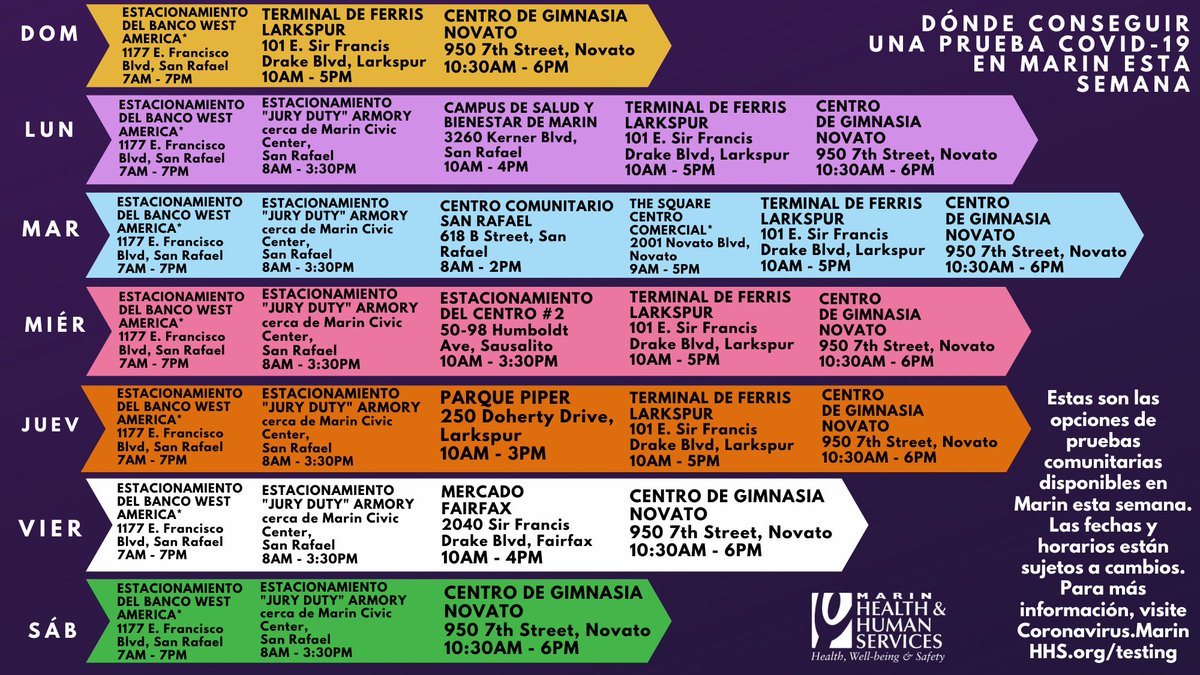

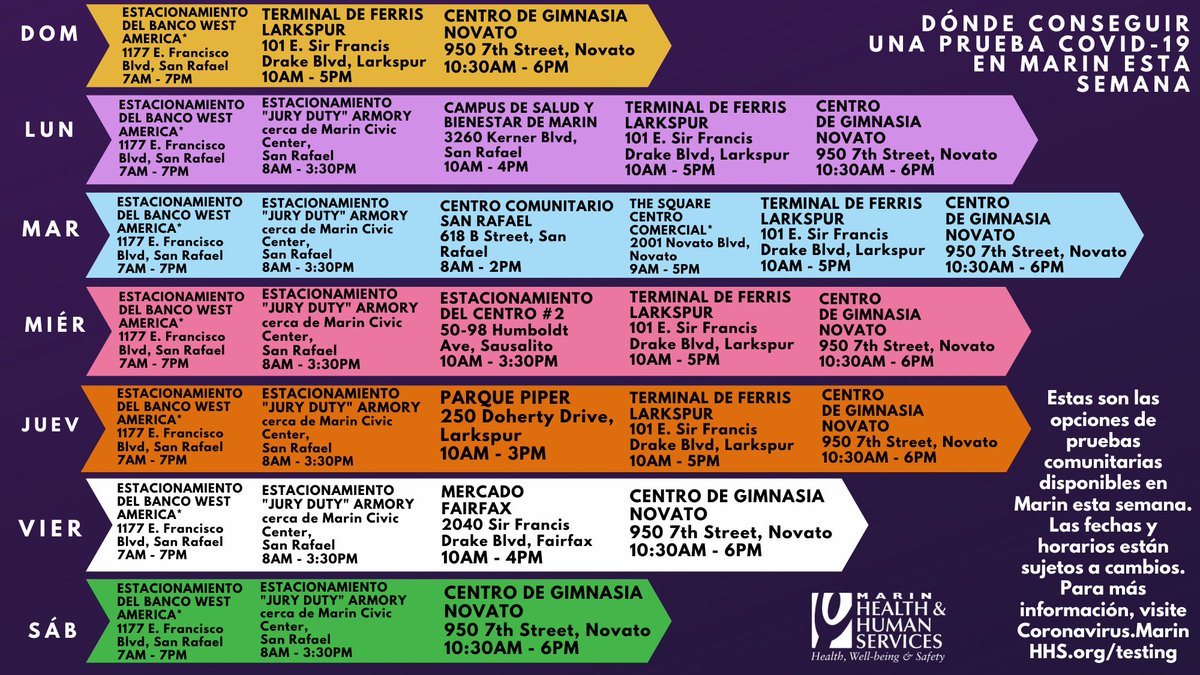

Marinhealth Humansvc Marinhhs Twitter

Marin County Policy Protection Map Greenbelt Alliance

Property Tax Bills On Their Way

Community Action Marin Facebook